In industries that rely on metal, from electronics and automotive to jewelry and investment, knowing the levels of precious metals is essential. Purity and grading determine everything: a material’s market value, its performance in manufacturing, and even its legal classification for trade.

Yet many businesses and recyclers unknowingly leave money on the table due to confusion around metal classification. What qualifies as high-grade? How does karat compare to fineness? What standards define investment-grade versus industrial-grade metals?

This guide breaks down the science behind precious metal grading, explaining how metals are classified, what purity levels really mean, and why proper testing is crucial. Whether you’re dealing with gold, silver, platinum, or other precious materials, understanding their levels is the first step to making smarter, more profitable decisions.

What Are Precious Metals?

Precious metals are rare, naturally occurring elements valued for their unique physical and chemical properties, especially their resistance to corrosion, high conductivity, and luster. Unlike common base metals, precious metals retain their value over time, making them essential in both industrial applications and financial markets.

The most widely recognized precious metals include gold, silver, platinum, and palladium. These are used across industries, in electronics, automotive catalytic converters, medical devices, and jewelry. Their rarity and usefulness contribute to their high market value.

What makes them “precious,” however, isn’t just scarcity. It’s also their purity and composition. These qualities directly affect their grade, usability, and price. Understanding how these metals are classified is key to determining their real-world value, especially when buying, selling, refining, or recycling them.

Learn more in our precious metals analysis services.

Understanding Metal Purity Levels

When assessing the levels of precious metals, the most important factor is purity. This refers to the proportion of the metal that is unalloyed and free from other elements. Purity directly influences value, usability, and classification.

Karat vs. Fineness: What’s the Difference?

For gold, purity is often measured in karats. Pure gold is 24 karats, while 18k gold contains 75% gold and 25% other metals. This system is mostly used in jewelry.

Other precious metals like silver, platinum, and palladium are measured by fineness, typically expressed as parts per thousand. For example, platinum marked as “950” is 95% pure. A fineness of 999 (or “three nines fine”) indicates extremely high purity.

| Metal | Purity Format | Example |

|---|---|---|

| Gold | Karats (k) | 18k = 75% gold |

| Platinum | Fineness | 950 = 95% platinum |

| Silver | Fineness | 999 = 99.9% silver |

Why It Matters

Whether you’re melting metals, selling scrap, or certifying bullion, knowing metal purity levels helps avoid undervaluation or disputes. Slight differences in purity can mean a significant price difference, especially in high-volume or high-value transactions.

Precious Metal Grading & Classification Systems

Beyond purity, precious metal grading provides an added layer of classification that reflects how a material is used, processed, and valued. Grading systems vary across industries but typically categorize metals into low-grade, mid-grade, or high-grade classes.

What Do Grades Represent?

- Low-Grade Metals: Often contain significant impurities or are blended with non-valuable materials. Common in electronic scrap, catalytic residues, and mixed alloys.

- Mid-Grade Metals: Have moderate purity and are frequently found in consumer products like jewelry or household electronics.

- High-Grade Metals: Exhibit high fineness or karat levels and are often used in investment products such as bullion bars, coins, or certified industrial materials.

Purity vs. Grade

While purity refers to the metal’s chemical composition, grading considers additional factors such as contamination, marketability, and whether the material requires extensive refining. For example, two metals with similar purity may be graded differently based on origin or recoverability.

Why Grading Matters

For recyclers, refiners, and manufacturers, metal grade affects everything from pricing to processing method. Misclassification can lead to financial loss, especially when dealing with bulk materials or high-stakes transactions.

Industrial vs. Investment Grade Metals

Not all high-purity metals are created for the same purpose. In the world of precious metals, there’s a clear distinction between industrial and investment-grade classifications, each with different quality expectations, applications, and handling requirements.

Industrial Grade Metals

These are used in manufacturing processes, electronics, catalytic converters, and other functional applications. While they must meet specific performance standards, they often contain trace impurities or are alloyed for durability. Their value lies in utility, not aesthetics or storage.

Examples include:

- Platinum in automotive catalysts

- Silver in solar panels or circuit boards

- Gold plating in connectors or semiconductors

Investment Grade Metals

Investment-grade metals are refined to extremely high purities and certified for storage, trade, or portfolio diversification. These include bullion bars, coins, and ingots, often accompanied by assay certificates confirming fineness.

They are:

- 99.9% or higher in purity (for example, 24k gold, 999 silver)

- Stored securely and rarely circulated

- Priced based on market value with premiums for condition or origin

Understanding this distinction helps businesses optimize their strategy, whether extracting value from scrap or securing long-term assets.

How Metals Are Tested and Verified

Accurate classification of precious metals, whether by grade, purity, or value, depends on proper testing and verification methods. This is where metal assay testing plays a crucial role.

Assaying is the process of analyzing a sample to determine its elemental composition, typically done in ISO-accredited laboratories using high-precision instruments. It’s essential for:

- Confirming metal purity

- Certifying bullion or ingots

- Determining value for trade or refining

- Ensuring compliance with industry or regulatory standards

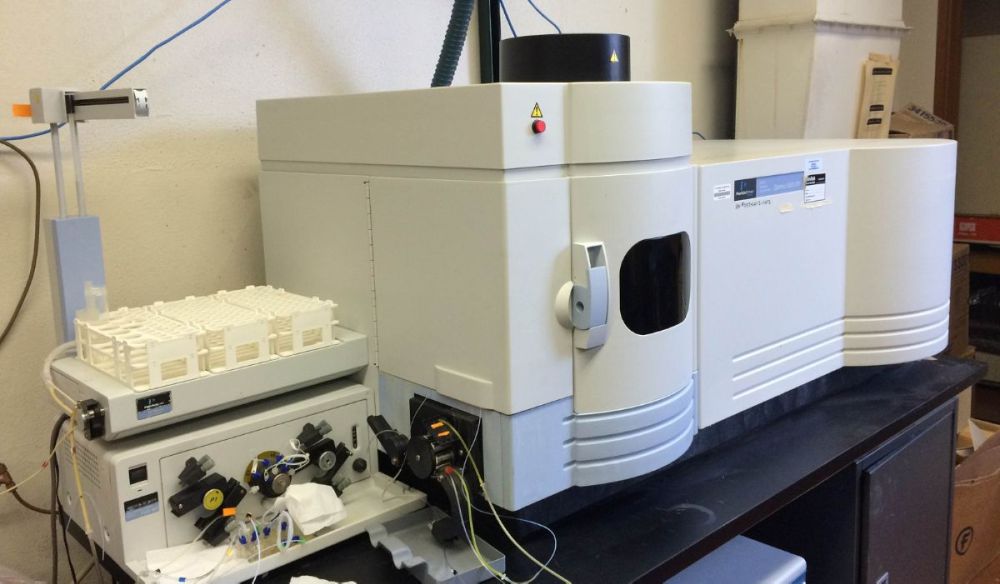

Common Assay Methods

- X-ray Fluorescence (XRF): A fast, non-destructive technique for surface-level analysis.

- Inductively Coupled Plasma (ICP): Highly sensitive, lab-grade analysis capable of detecting trace elements.

- Fire Assay (for gold/silver): The industry’s most reliable method for determining precious metal content.

- Wet Chemistry: Used for complex materials like catalysts or escrap.

Why Professional Testing Matters

DIY tests or visual inspections may provide rough insights, but only lab-grade assay testing delivers data trusted by refiners, traders, and financial institutions. A misidentified material could result in undervaluation or legal disputes, especially in bulk shipments or investment trades.

Why Levels of Precious Metals Matter for Recyclers & Refiners

For recyclers, refiners, and scrap processors, understanding the levels of precious metals isn’t just about classification. It’s about maximizing return on materials and minimizing risk.

In many cases, valuable metals are hidden in mixed or contaminated materials like:

- Spent automotive catalysts

- Electronic waste (escrap)

- Low-purity alloys or copper concentrates

Without proper testing, these materials can be undervalued, rejected, or mispriced, leading to lost revenue or missed opportunities.

Knowing whether a material is low-grade industrial scrap or high-grade investment metal changes how it should be handled, refined, and marketed. Testing also helps prevent overpayment for underperforming batches or falling short on quality when delivering to buyers.

This is where independent, ISO 17025-accredited laboratories like Ledoux & Co. play a critical role. They provide reliable documentation and analysis to help you protect margins, verify quality, and move forward with confidence.

Final Thoughts & Actionable Takeaway

The levels of precious metals, from low-grade industrial scrap to high-purity investment bullion, influence everything from pricing and processing to long-term strategy. Purity, grading, and accurate testing are the foundations that determine true value.

For businesses in recycling, refining, or trading, relying on assumptions can be costly. Accurate precious metal grading and assay testing ensures you receive the fair market value for your materials and avoid unnecessary risks.

If you’re working with electronic scrap, catalysts, or bullion, partnering with an experienced, independent laboratory makes all the difference. With over 140 years of expertise, Ledoux & Co. provides ISO 17025-accredited analysis you can trust. Submit your sample today and gain clarity on the real worth of your